The healthcare business is well-known for its high-paying employment. Medical practitioners deserve the privileges that come with their job, such as superb benefits and high incomes, after years of intensive study and training. Furthermore, according to the Bureau of Labor Statistics, the top 14 highest-paying jobs in the United States are all in healthcare.

Medical practitioners, like any other high-earning profession, might succumb to the issue of “lifestyle creep.” This word refers to the tendency to spend more when one’s income increases. Because of the long hours they spend with their high-earning colleagues and the fact that their hard-earned degree and proper salary can become tightly connected to their sense of self, medical professionals are especially sensitive to this.

It is critical for medical professionals to reflect on their relationship to the purpose of their lives and identify areas that may require attention. While financial security is important, it’s also important to remember why you chose a job in healthcare. Remembering your purpose can help you prioritize your spending and ensure that your lifestyle is consistent with your ideals.

It is also critical to handle any issues that may arise. This could involve creating a budget or financial plan to avoid overspending, getting financial advice, or finding ways to give back to the community through volunteering or charitable donations.

As medical professionals enjoy the perks that come with their high-paying jobs, it’s crucial to remember the purpose behind their work and to avoid falling victim to lifestyle creep. By prioritizing their values and addressing any areas that may require attention, medical professionals can maintain a balanced and fulfilling life both in and outside of their careers.

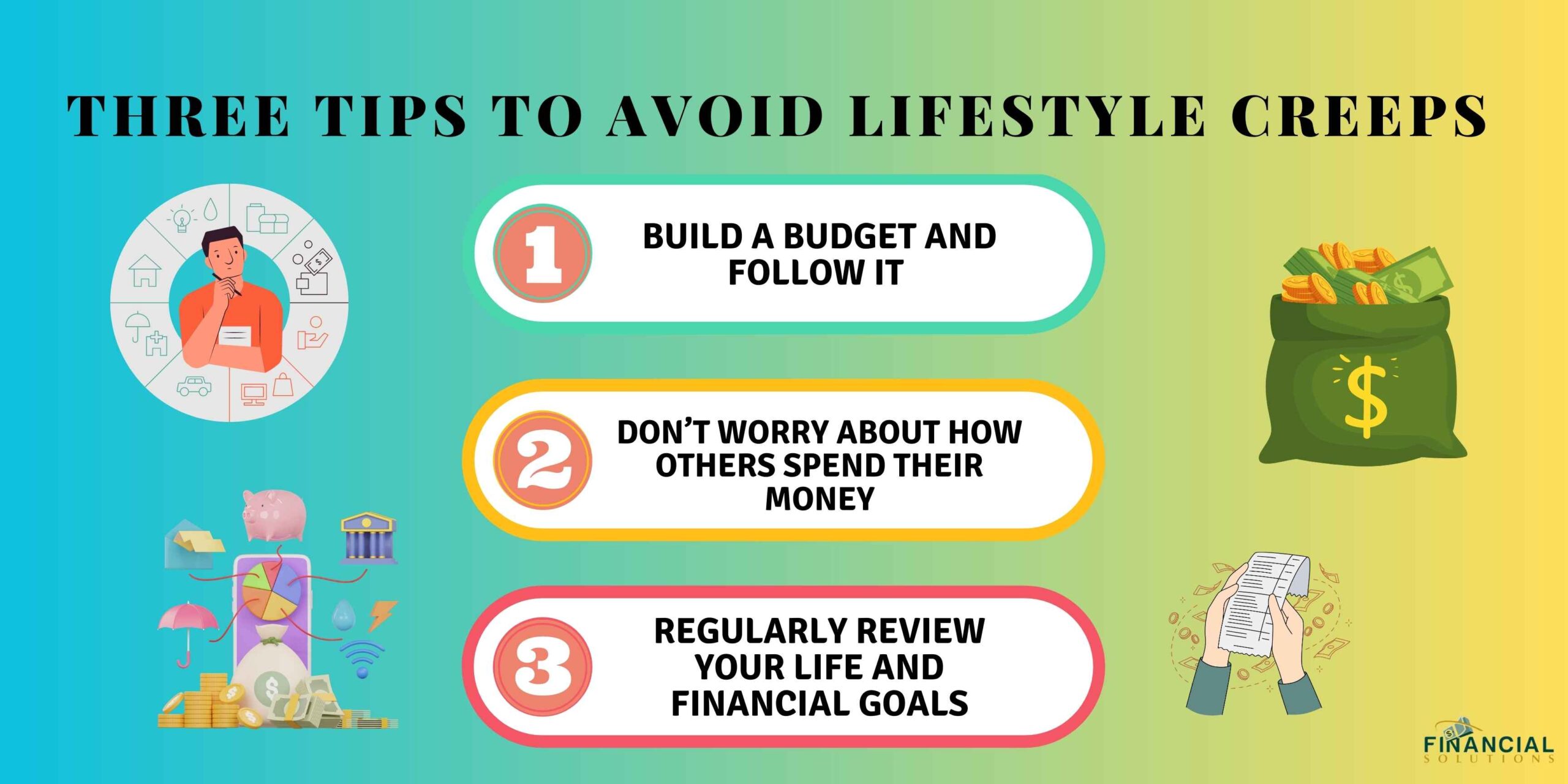

Here are three tips that can help medical pros avoid lifestyle creep and stay focused on improving their Return on Life:

1. Build a budget and follow it.

According to the American Medical Association, a first-year resident physician makes an average of $60,000 per year. While this may appear to be a large sum of money, it may just be a fraction of what you owe in student loans. As a result, before indulging on luxuries like credit cards and home entertainment systems, it’s critical to create a budget that allows you to live comfortably while simultaneously paying off debts and contributing to savings and investment accounts.

As a medical practitioner, your salary will skyrocket once you complete your residency. According to Salary.com, the median beginning income for a doctor in the United States is $207,532, and this figure only rises for in-demand specialties. Nonetheless, this wage rise should not be viewed as a windfall. Instead, it’s critical to reassess your budget, suitably enhance your lifestyle, and continue to pay off your debts and invest in your future.

Maintaining a healthy work-life balance and staying on track with your financial objectives will be easier if you manage this rise in income properly. It’s critical to avoid lifestyle creep, which is the inclination to splurge as income grows. You can guarantee that you’re living within your means while also saving and investing for the future by evaluating your budget.

It is critical for you to handle your money wisely as a medical practitioner. You may preserve financial security while enjoying the advantages of your hard-earned salary by setting and keeping to a budget, paying off your debts, and investing in your future.

2. Don’t worry about how others spend their money.

You’ve worked hard as a healthcare professional to earn money, respect, and identity that come with the job. But balancing these aspects can be difficult, especially at the start of your career. While you have earned the right to enjoy the fruits of your labor, you must avoid the trap of lifestyle creep and keep your costs in line.

Attempting to keep up with your friends may exhaust your resources, especially if you replace your student loan debt with hefty credit card payments or luxury leases. In the long run, this could jeopardize your potential to accumulate wealth. Furthermore, purchasing items may not provide the long-term enjoyment that we desire. After a while, your new yacht or sports car will be just another item in your collection.

It’s critical to stay on track by focusing on your own objectives and priorities rather than trying to keep up with someone else’s lifestyle. If you must indulge yourself, consider investing in experiences that will give lasting memories and broaden your worldview. You may, for example, travel to a new location, attend a cultural event, or enroll in a program to master a new skill.

Managing money, accomplishment, respect, and identity difficulties can be difficult for healthcare workers. Yet, you may retain financial stability and create important memories that will last a lifetime by avoiding lifestyle creep, staying focused on your goals, and investing in experiences rather than stuff.

3. Regularly review your life and financial goals.

Your goals and priorities may change as you advance in your healthcare profession. Perhaps you’d like to reduce your working hours in order to devote more time to mentoring or volunteering. If you’ve dutifully saved and invested over the years, you might be thinking of beginning your own practice or retiring early.

Whatever your long-term objectives are, following a financial plan can give the foundation you need to achieve these adjustments. You can pursue new goals while still enjoying the present moment if you incorporate Life-Centered Planning into your financial approach.

A detailed financial strategy is crucial at any point of your professional journey. Whether you’re just starting out in your career or thinking about your next step, consulting with a financial professional can help you establish a plan to reach your objectives.

Working with a financial advisor allows you to receive insights into the most recent financial trends and develop a customized plan that is tailored to your specific goals. A financial advisor can give the assistance and support you need to keep on track, whether you want to focus on debt reduction, retirement planning, or investing techniques.

In conlusion, it is critical to acknowledge that your goals and priorities may shift as you advance in your healthcare profession. You may remain on top of your finances and follow your objectives while still enjoying the current moment by adopting Life-Centered Planning and receiving advice from a financial specialist.