Filing past year tax returns can be a difficult and overwhelming task, especially if you do not have the necessary documents. However, the Internal Revenue Service (IRS) has provided a solution to this problem called the Wage and Income Transcript service. This service allows taxpayers to obtain information about their income and tax withholdings from previous years, which can be used to file past year tax returns.

At Financial Solutions, we understand the challenges that come with filing past year tax returns. To make this process easier for our clients, we offer a specialized service that is designed to assist with this process. Our team of experts will work closely with you to gather all the necessary information and ensure that your past year tax returns are filled accurately.

Using the Wage and Income Transcript service is a simple and straightforward process. You can request a transcript online, by mail, or by phone. Once you have obtained the necessary information, our team will help you file your past year tax returns accurately and efficiently.

What is the Wage and Income Transcript?

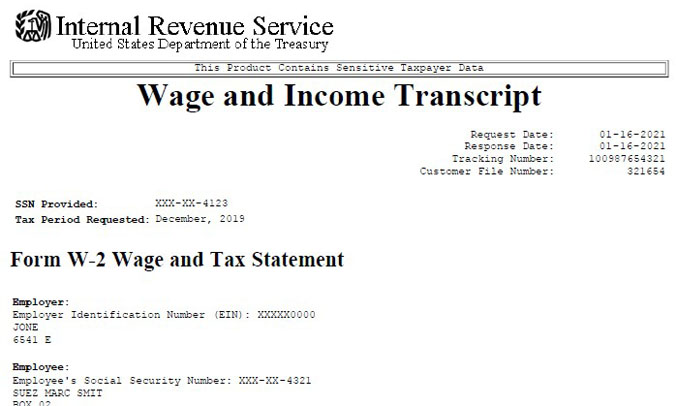

The Wage and Income Transcript is a document provided by the IRS that contains information about your income and tax withholding for a specific tax year. This information is reported to the IRS by your employers, banks, and other financial institutions. The Wage and Income Transcript is available for up to 10 years after the tax year in question.

Step-by-Step Guide to Filing Past Year Tax Returns with the Wage and Income Transcript:

Step 1: Gather Your Information

Before you begin the process of using the Wage and Income Transcript, you will need to gather some information. This includes:

- Your Social Security number

- Your date of birth

- Your filing status for the tax year in question (single, married filing jointly, etc.)

- Any other relevant information, such as income from self-employment or rental properties

Step 2: Request Your Wage and Income Transcript

To request your Wage and Income Transcript, you can visit the IRS website and use the Get Transcript tool. Here’s the link to access the tool: https://www.irs.gov/individuals/get-transcript

Here’s how to request your Wage and Income Transcript:

- Go to the IRS website and click on the “Get Your Tax Record” button.

- Follow the prompts to verify your identity. You will need to provide your Social Security number, date of birth, and filing status for the tax year in question.

- Select “Wage and Income Transcript” as the type of transcript you want to receive.

- Choose the tax year for which you need the transcript.

- Click “Continue” and follow the prompts to complete the request.

- Once your request is processed, you will receive a copy of your Wage and Income Transcript in the mail.

Step 3: Complete Your Tax Return

With your Wage and Income Transcript in hand, you can now begin the process of completing your past year tax return. You can use tax preparation software or work with a tax professional to ensure that your return is accurate and complete.

When completing your tax return, be sure to include all of the income and withholding information from your Wage and Income Transcript. If you had any additional income or deductions that are not included on your transcript, you will need to gather documentation to support those items.

Step 4: File Your Tax Return

Once your tax return is complete, you can file it with the IRS. You can file electronically or by mail, depending on your preference. If you owe taxes for the past year, be sure to include payment with your return to avoid penalties and interest.

Why File Past Year Tax Returns?

Filing past year tax returns is important for several reasons. First, it is a legal requirement. If you fail to file your tax return, you may face penalties and interest charges. Additionally, if you are owed a refund, you will not receive it until you file your return.

Filing past year tax returns can also help you avoid future problems with the IRS. If you have unfiled tax returns, the IRS may initiate an audit or take other enforcement actions against you. By filing your past year tax returns, you can avoid these potential issues.

Finally, filing past year tax returns can help you get caught up on your taxes and put your financial affairs in order. This can give you peace of mind and help you avoid stress and worry about your tax situation.

Benefits of Using the Wage and Income Transcript

Using the Wage and Income Transcript to file past year tax returns has several benefits. First, it eliminates the need for you to gather and organize your own tax documents. This can save you time and effort, especially if you have lost or misplaced your tax records.

Second, the Wage and Income Transcript provides a comprehensive record of your income and tax withholding for the tax year in question. This can help ensure that your tax return is accurate and complete.

Finally, using the Wage and Income Transcript can help you avoid potential errors or omissions on your tax return. By using the information provided on the transcript, you can be confident that you have included all of the necessary income and withholding information on your tax return.

Penalties for Not Filing Past Year Tax Returns

The IRS assesses penalties on taxpayers who fail to file their tax returns on time. The penalty for not filing past year tax returns is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. If your return is more than 60 days late, the minimum penalty is the lesser of $435 or 100% of the unpaid tax.

For example, if you owe $10,000 in taxes for the 2022 tax year and you file your return three months late, your penalty would be $1,500 (5% of $10,000 x 3 months). If you file your return more than 60 days late, your penalty would be $435 or 100% of the unpaid tax, whichever is less.

It is important to note that the penalty for not filing past year tax returns is separate from the penalty for not paying your taxes on time. If you owe taxes and do not pay them by the due date, you will also be subject to a penalty for late payment.

Interest Charges for Not Filing Past Year Tax Returns

In addition to penalties, the IRS also assesses interest charges on unpaid taxes. The interest rate is determined quarterly and is based on the federal short-term rate plus 3%. The interest is compounded daily and accrues from the due date of the return until the tax is paid in full.

For example, if you owe $10,000 in taxes for the 201 tax year and you do not pay them until three years later, you would owe approximately $3,000 in interest charges alone (assuming an interest rate of 6%). This is in addition to any penalties assessed for late filing or late payment.

How to Avoid Penalties and Interest Charges

The best way to avoid penalties and interest charges for not filing past year tax returns is to file your returns as soon as possible. Even if you cannot pay the full amount of taxes owed, it is better to file your return and make a partial payment than to not file at all.

If you cannot pay your taxes in full, you may be eligible for an installment agreement, which allows you to pay your taxes over time. You can apply for an installment agreement online or by mail using Form 9465.

If you are unable to pay your taxes due to financial hardship, you may be eligible for an Offer in Compromise, which allows you to settle your tax debt for less than the full amount owed. However, the IRS has strict guidelines for determining eligibility for an Offer in Compromise, and it is best to consult with a tax professional before applying.

Working with a Tax Professional

If you are unsure about how to file past year tax returns or have questions about your tax situation, consider working with a tax professional. A tax professional can provide guidance and advice on your tax situation, help you navigate the tax code, and ensure that your tax return is accurate and complete.

Additionally, a tax professional can help you minimize your tax liability and avoid penalties and interest charges. They can also help you explore options for paying your taxes, such as an installment agreement or Offer in Compromise.

Failing to file past year tax returns can have serious consequences, including penalties and interest charges. These penalties and interest charges can quickly add up over time, making it even more important to file past year tax returns as soon as possible. By filing your returns and working with a tax professional, you can minimize your tax liability and avoid penalties and interest charges. At Financial Solutions Inc., we offer expert tax preparation services to help you get caught up on your taxes and avoid penalties and interest charges. Contact us today to schedule a consultation and let us help you navigate the tax filing process with ease.

If you’re looking for professional help with your taxes or other financial needs, visit our website Our team of experts is ready to assist you with all your financial needs. Don’t wait until it’s too late, contact us today to schedule a consultation and take control of your financial future! We also offer a range of services to help you manage your finances effectively. Our services include bookkeeping, accounting, tax, financial planning, and investment management.

Oh, hey! I love it when you encouraged us to include all of our earnings and withholding details from our transcript while filing our tax return. My wife and I are getting busier lately trying to complete our respective tax files. Maybe we need to hire a prepper to help us out.

I really enjoyed reading this post, thank you! Fantastic job!