Small business retirement plans

Financial Solutions

December 8, 2022

When you are a sole proprietor of a small business, such as a Shopify store, it’s critical to know all your retirement vehicle options are. Retirement planning is something that is easily neglected.

You may currently lack the funds to contribute to a retirement account, or you may utilize that amount to keep your small business afloat, or you may use the funds to pay down existing debt, either personal or business.

However, one thing you must do is consider the time value of money. That is, the longer you wait, the less money you have saved and the more you will have to play catch-up to beef up your retirement account.

Saving for retirement can seem as a challenging endeavor. However, with automatic withdrawal set-up from your bank account, the process for saving can be simplified and remove any action or thinking on your part.

Working with a knowledgeable financial planner can make retirement savings relatively easy and straightforward by providing the appropriate invest vehicles keeping one’s tax bracket in mind. By keeping accurate books, we are able to better tax plan and invest in suitable retirement options.

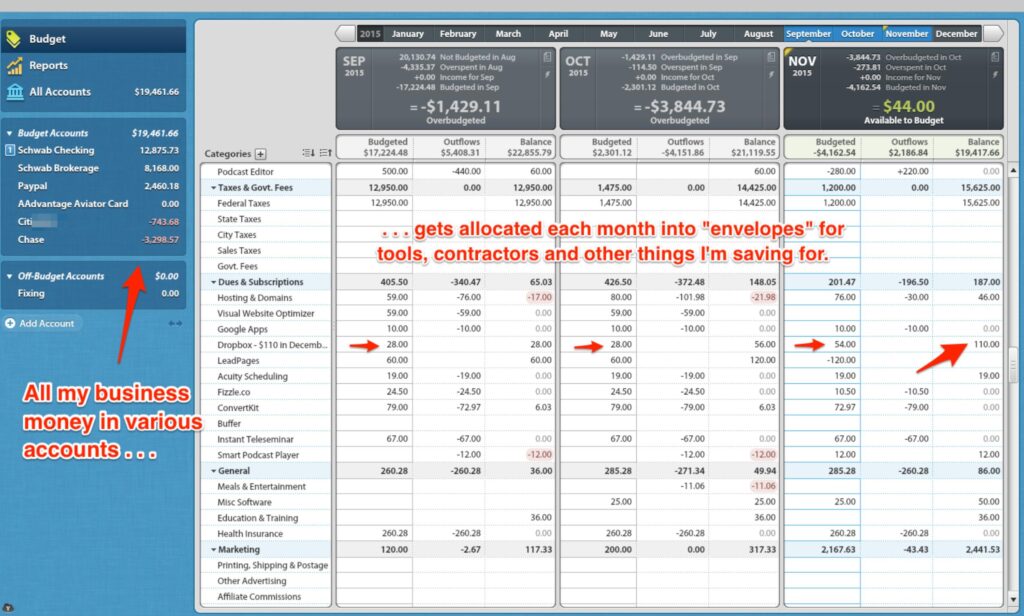

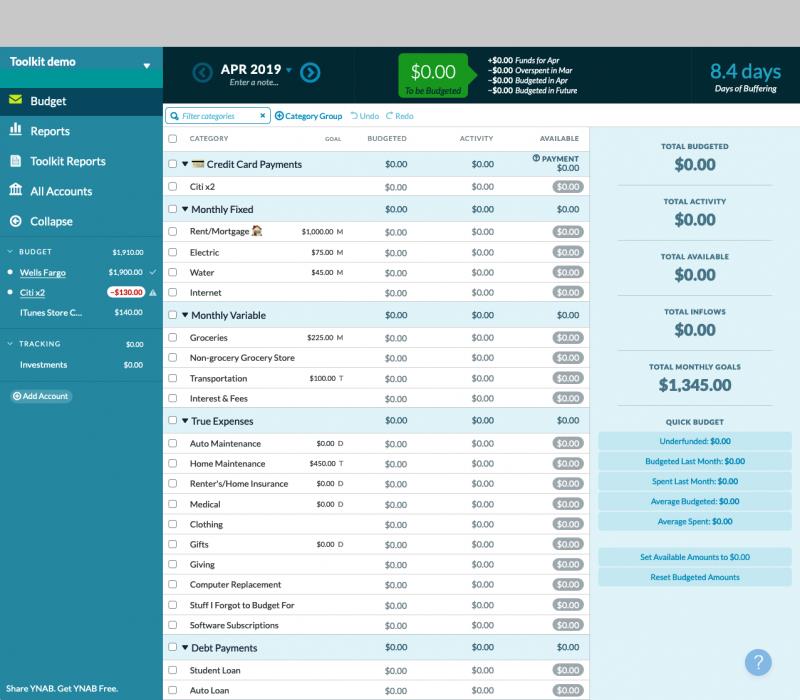

Before diving into a retirement plan from your small business, you must get intimate with your cash flow. That is knowing what is flowing in and out of your bank account on a monthly basis.

This way, you will be able to segregate fixed expenses, such as rent or mortgage, utilities, school tuition fees, etc. verses variable expenses, such as dining out, entertainment, club dues, etc. In essence, the first step to a well thought-out retirement plan, is the creation of a budget.

You can use a budgeting app, such as YNAB or even a simple Excel spreadsheet or a pen and paper. Each budgeting tools has its own pros and cons. At Financial Solutions, we can help you create a budget, and help you stay on track with your expenses so that you can meet your goals.

A budget is often misconstrued as a restrictive controlling tool to not allow you to have discretional money, i.e. “fun money.” However, that is not the case; the purpose of a well constructed budget is to create mindfulness so that you are more aware of what you are spending and when you are spending so that you can make better choices that are aligned with your long term and short term goals.

There are many philosophies as to how much cash you will need to have to live a comfortable life when you retire from your small business. Whatever that amount may be, it’s imperative to be active with your savings if you want to meet your retirement objectives.

One thing to ponder is, what are you retiring to? What does retirement mean? This will help us stay motivated and stay the course of savings if we have a clear image of what retirement looks like for us?

For example, what would your typical day in retirement look like? Who would we like to spend your retirement days with and where? These are important questions that we at Financial Solutions help explore with our clients when we are putting together their financial plan.

A financial advisor should create a financial plan tailored to your phase of entrepreneurship and include various retirement investment options. Additionally, you must decide your long term goals are for your small business, i.e. if you intend to sell the company, cease operations, or transfer ownership to someone else.

Here are four strategies to help ensure that you are reviewing all of your retirement options appropriately.

1. Base retirement planning activities on what stage you are in your business

There is no doubt that you are thinking about retiring differently from when you are just starting out compared to when you’ve been operating your business for decades and are ready to throw in the towel and retire. Ignoring long-term retirement planning is one of the biggest mistakes a small business owner can make as they have not given retirement its full attention that it deserves, and not allowed their money to compound and grow into a substantial nest egg amount.

A business typically goes through (3) phases; initial, growth, and phase out. The following must be taken into account at each stage as you plan for retirement:

Initial: At this stage you have just started your business and are wearing many hats. For many business owners, they have been previously employed at another business as an employee, and contributed to a retirement plan.

Now, as a business owner, they need to roll over their existing retirement plan from prior employment into an appropriate retirement vehicle such as a Solo 401K or a SEP (Self Employment Pension Plan). Having a discussion with a knowledgeable financial planner to evaluate all of your retirement options as a small business owner is a good starting point in your retirement planning.

In addition, continuing to contribute towards your retirement nest egg is important to ensure that your retirement account continues to grow and compound.

Growth: At this stage you own an established business with a few years of business ownership under your belt: After operating your company for 10 or 15 years, you will now have employees that you will have to set-up with retirement accounts and provide company matching and profit sharing to keep your employees motivated and wanting to grow with you and your business.

As a small business owner, you need to concentrate on maximizing your contributions for your retirement plan as well. This is also a good time to evaluate your net worth by creating a personal financial statement which details out your assets and liabilities so that you can change or alter your financial course if needed so that your financial goals can be met.

Phasing Out: This is when you are winding down your small business and are making plans for your retirement years. It’s crucial to get your business affairs in order and have an exist game plan as you are close to retirement age. This game plan can entail boosting your boosting your business’s net worth by increasing your company’s assets both physical and digital, analyzing the market, and locating potential buyers if you plan to sell.

Choosing an effective communication strategy for long-term clientele is essential so that they remain with the company and the new owner(s) even after your exit, is another important decision.

2. Work with a financial planner

A financial planner will help put together a financial plan that takes into account your long term and short term goals both personal and business. It is imperative that you prepare for and handle potential retirement issues, such as needing long term care or disability care with the assistance of an experienced financial planner.

Additionally, the financial planner that is a CPA, may collaborate with you to improve your business’s financial stability. A financial planner will assist you during the start-up period by assisting you to maximize your initial investment, evaluate the viability of your business model, and develop plans for sustainability.

Your financial planner along with your investment manager, keep an eye on your personal and corporate accounts over time and integrate them for the best cash flow, tax planning, and investment objectives. Working with your financial planner along with your investment manager are also able to spot issues and stop financial misconduct.

Working with a well rounded team that includes a CPA, Financial Advisor, and Investment Manager such as at Financial Solutions, Inc. is essential for long term planning as well. The team offers a fresh business viewpoint, provides insight into potential market disruptions, and provides knowledge of new tax laws.

3. Pick the right mix of retirement vehicles

You can fund your retirement with either tax-deferred or taxed funds. For example, a regular IRA (Individual Retirement Account) also known as a traditional IRA can be set-up with tax deferred funds v.s. a ROTH IRA that is set-up with funds that have already been taxed.

A ROTH IRA allows tax free withdrawal of compounded funds. Unfortunately, 34% of small business owners have no personal retirement funds as reported in an article by Forbes.

However, you can start small to kick off your retirement savings plan. Moreover, automating funding into your retirement account, will ensure that you are constantly contributing without having to think about it.

Choosing a suitable retirement account

Traditional IRA

Anyone (including a non-working spouse) having income from a job or self-employment is eligible to use an Individual Retirement Account (IRA). Even if you don’t itemize deductions, payments are still deductible for tax purposes.

Let’s say you earn $50,000 before taxes. If you contribute the maximum, $6,000 (for tax year 2022) and you are under the age the age of 50 into a Traditional IRA, you will have to report and pay tax on only $44,000 in income. This will help reduce your tax burden and provide funds for your retirement.

Additionally, you won’t be taxed on investment gains until you begin taking money out from this retirement account. Currently the withdrawal age without any restrictions or penalties is 59-1/2. (Remember that early withdrawal may be subject to fines, penalties, and taxes)

Roth IRA

An alternative to a standard or traditional IRA is a Roth IRA. Pre-tax money is contributed to a standard or traditional IRA. Money which has already been taxed can them be contributed to a Roth IRA. Similar to the standard or traditional IRA, the maximum that you can contribute to a Roth IRA is $6,000 (for tax year 2022) for anyone under the age of 50.

Although contributing already taxed money can seem like a drawback, there is one important benefit, when you start taking withdrawals at retirement age, currently 59-1/2, there is no income tax to be paid on the earnings in the account.

The younger you are, the better it works for you as you allow your investment to compound turning a small amount into a tidy nest egg. For example, if you are 30 years old and contribute the maximum allowable amount into your Roth IRA, without any early withdrawals, up until you reach retirement age, even relatively modest annual returns, could add up to a hefty sum—a hefty sum that you can now withdraw when you are retired completely tax-free.

SEP-IRA

A SEP-IRA (Simplified Employment Retirement Plan) is a plan designed for a small business owner with (100) or fewer employees or if you are self-employed. The contribution with a SEP-IRA is unique as it is 100% employer funded. The employee cannot contribute to this retirement fund. Also, the contribution is limited to 25% of the net earnings or up to $61,000.00 per year for tax year 2022, the lesser of the two. This amount is the total amount that can be contributed to the SEP-IRA for the business, whether it is used for the sole proprietor business owner or the maximum (100) employees under this retirement plan.

In a SEP-IRA the business owner can decide how much to contribute to this retirement plan each year. Thus, if a business owner wants to contribute 12% of their own net earnings into a SEP-IRA, they must use the same percentage of contributions for their employees based on the employees net earnings. However, since this retirement plan is 100% employer funded, the employer does not withhold 12% of their employees’ net earnings. The employees’ salary is only used to figure out how much the employer needs to contribute to the employees SEP-IRA. The SEP-IRA contribution is in addition to their employees’ income.

One of the key benefits of a SEP-IRA is that the employer can contribute into the retirement plan up to the next year’s tax deadline, April 15th or if applied for an extension to file, till the extension date, October 15th. This allows the employer to gauge whether they have made a profit in their business and wish to reduce their tax burden by making the maximum contribution allowable into the SEP-IRA.

According to the IRS there are several types of participants that can set-up and that can contribute to a SEP-IRA. These participants include small-business owners, solo-entrepreneurs and contractors with independent businesses.

Setting up a SEP-IRA is easy as setting up an IRA and can be done at Financial Solutions, Inc..

Solo 401(k)

A Solo 401(k) is a company retirement plan designed for business owners with no employees.

The Solo 401(k) plan is available in two variants. You can choose between a traditional Solo 401(k) plan with pre-tax contributions or a Roth-style Solo 401(k) plan with after-tax contributions.

The contribution limit for a stand-alone 401(k) plan is $61,000 for tax year 2022, increasing to $66,000 in 2023, with an additional $6,500 catch-up contribution if 50 or older in 2022, or an additional $7,500 in 2023.

401(k)

A 401(k) plan is a retirement savings plan offered by many US employers that has tax advantages for the saver. It is named after section 401(k) of the U.S. Internal Revenue Code (IRC). Below are some key advantages:

- Elective salary deferrals are excluded from the employee’s taxable income

- Optional loans and hardship withdrawals provide an additional benefit for employees

- Employee can set-up a percentage of their pay as a contribution into the retirement account

- The employer may match part or all of the employee contribution

- The employee gets to choose among a number of investment options, usually mutual funds.

- The employee deferral limit is $20,500 in 2022.

If you set up a standard 401(k) plan, you must offer your employees the same plan benefits that you receive.

A common question that is asked by Shopify Owners that work a full time job and also have a Shopify business, is whether a contribution can be made to a SEP-IRA and a 401(k)? If your full job offers a 401(k) plan and you own your own business, you can contribute to both retirement plans simultaneously. As long as the two entities have no overlap, you can open a SEP-IRA for your Shopify business while still contributing to your 401(k) for your full time job.

4. Develop a succession plan

It is important to create a succession plan that aligns with the goals of the business owner. If you are planning on selling your Shopify company (for example), transfer ownership, or downsizing when you plan to retire, a well thought out plan should be put in place so that the right infrastructure and growth strategies are executed.

According to SCORE, 18% of small business owners plan to sell their business to fund their retirement. However, before you even think about selling your business, you will want to perform your own research about the best options that would align with your goals, work on increasing your businesses’ net worth, speak with a financial advisor, and ensure that you have your business and personal affairs in order.

Key takeaways

Planning for retirement as a small business owner is a necessary part of running your business. The sooner you start contributing to a retirement plan, no matter the dollar amount, the sooner you will allow time value of money to work its magic.

Ultimately, you must follow your own heart’s desire to reach the goals that to want to achieve. One must not adopt a herd mentality, and opt for the most popular route simply because everyone else is doing it or because it feels like a safe bet.

As mentioned earlier, getting professional financial advice that is tailored to your needs will make your retirement decision-making in this regard more suitable and in alignment with your dreams and goals.

Another factor to consider is how your retirement plans will affect other people, including your family, your employees, and your valued customers. Your financial decisions now could affect the lifestyle you and your family will be able to enjoy in your later years.

You also have to think about your valued customers and employees and have plans and procedures set and in-place prior to finalizing your retirement plans. Another important decision is whether you want to leave your legacy for the next generation. Working with an Estate Planning Attorney will ensure your family is well taken care of when you are no longer around.

There’s no one size fits all as a retirement solution for everyone. However, saving for retirement is essential. The most important piece of advice, is to start the process of saving for your retirement, sooner rather than later, so that you have enough money to comfortably retire when the time comes.

If you have any questions, feel free to contact us and let us at Financial Solutions Inc., a Shopify specialist bookkeeping firm, help you with developing a robust retirement game plan.

You Shopify we Bookify!! ®

1 thought on “Small business retirement plans”

Leave a Comment Cancel Reply

Recent Posts

Have Any Question?

Amazing Financial Solutions

Lihue, Hawaii, 96766v

Thanks